This is an extract from The Poor Man’s Guide to Financial Freedom: A Realistic, 10-Step Manual to Building Liberating Wealth on a Small to Medium Budget.

International Diversification

As you saw in the box, there are a vast array of funds offered by Vanguard in some places. However, you’ll only need one or two of these funds to achieve all the share market diversification you need, plus perhaps a bond index fund as discussed earlier. Ignore all the weird and wonderful specialty funds.

Should you diversify your shares by investing in overseas stock markets, or stick with those in your own country? For example, take Steve, an Australian investor. Should he invest entirely in the Australian Shares Fund (which tracks the ASX 300), or should he also have some exposure to the International Shares Fund (which tracks several major indexes for overseas stock markets)?

On the pro side, diversifying internationally would help to hedge your bets in case your home country suffered a downturn. Further, if you plan to retire abroad, global shares will help with currency hedging – if your home country’s currency falls, your foreign shares will rise in value against that currency because they are denominated in different currencies.

On the cons side, overseas funds might further complicate your investments. If you know that you will retire in your home country, foreign shares can become a currency risk: if your own currency rises, those shares will fall in value for you. Some might also worry about investing in poorly regulated environments. Another consideration is that the more index funds you own, the higher fees you may pay.

Americans should note that foreign stocks tend to be more volatile than their own.

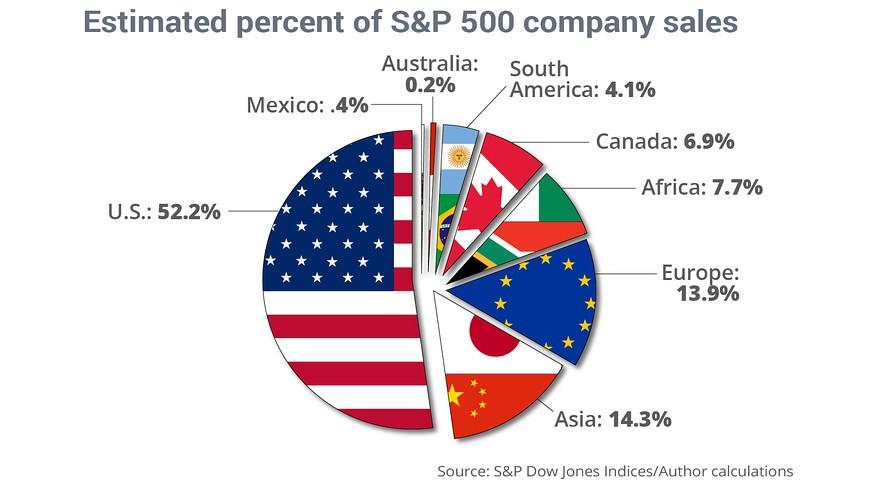

If you are an American, you can possibly get away with holding all-US funds because companies listed on the S&P 500 do a lot of their business abroad anyway.[i]

If you live in a smaller country with a less diverse economy, you would benefit by putting a quarter to a third of your shareholdings into overseas markets. The classic case would be Australia, where the economy is enormously dependent on only two sectors – resources and finance. In addition, the only foreign market exposure you’re really getting is China because of the huge proportion of trade with that country.

Some diversified funds already include a mix of local and international shares. If so, you’re all set. If not, you might need to purchase two funds, one for local shares and one for international shares. More on these diversified funds later.

Sometimes funds offer ‘hedged’ or ‘unhedged’ versions of the international shares product. Wot dat?

The ‘hedged’ one basically buys something like insurance against changes in currency, so that if your currency rises in value you do not suffer a loss, or the loss may be softened. The downside is that the fund must pay a fee for this, which cuts into your returns. ‘Unhedged’ means the fund does not pay for protection against currency fluctuations.

If you are investing for the long run as you should be, you might decide you don’t need to hedge as you have time to wait out short-term currency fluctuations. If you are risk-averse and such fluctuations make you panic, consider hedging for the sake of your heart health. If you are torn, it may also be possible to take a bet each way and hedge 50% of your international holdings.

As for the safety of foreign stock markets, don’t worry too much about your money disappearing into the lawless badlands of Venezuela or Eritrea. No offense to my Venezuelan and Eritrean readers, but you know what I mean. Most foreign investment, including from index funds, is directed towards developed countries with strong rule of law, and the single biggest destination for foreign investment in the world is the United States. So much for foreign capital taking advantage of Third World countries – their bigger problem is they don’t get enough of it.

Some index fund providers diversify a little into ‘emerging markets’, which means those less developed countries. If this is a small percentage of a diversified fund, that’s okay. They’ll only put the money into the safer options out of those countries. In fact, some funds have only recently expanded into China, and even there they cautiously keep the amount invested lower than that country’s gigantic economy might warrant.

Make sure your fund is set to ‘reinvest returns’. That means all the returns you make from dividends and so forth go back into the fund, generating even larger returns in the future through compounding. Having the returns regularly paid out to your bank is most often a strategy for retirees living off their investments, not for someone trying to build their wealth. And as always, make sure you read Step 9 and get individual advice before making any firm decisions.

[i] https://apurplelife.com/2019/10/29/why-i-own-100-us-stocks/

Also available on many other platforms.